If you are looking to start saving for a home but do not know where to start, this article is for you! These ten actionable money saving tricks will bring you one step closer to owning the home of your dreams!

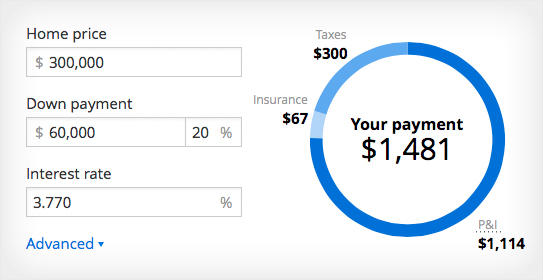

The average cost of a home in the United States is $248,000, meaning the average prospective American home buyer will need to have about $50,000 in savings to purchase their first home. So the sooner you can begin saving, the better! But depending on where you live, that number could be drastically different.

For many Americans, the home purchase is the largest purchase of a lifetime.

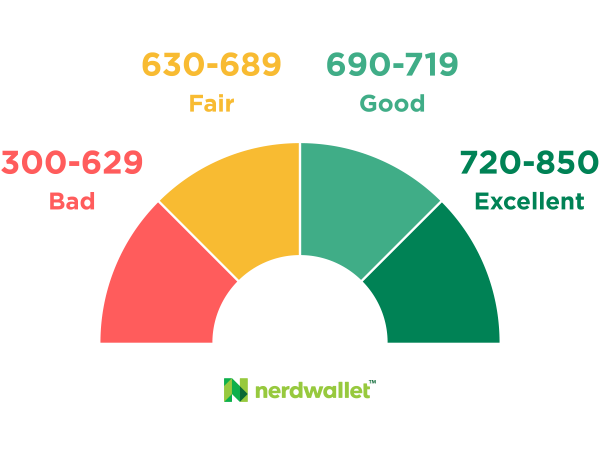

While it is possible to put as little as 3 percent down, rather than the usual 20 percent, it is entirely dependent on your credit score, and the state you live in. Putting less than 20 percent down might also make getting approved for a loan more difficult. Many states offer FHA loans and other down payment assistance options for first-time homebuyers. So it is well worth it to do your research and find out what is available in your state.

Before starting the process of saving for a home, potential buyers must identify how much they will need to save. To start, potential buyers must figure out exactly how much house they can afford. Once you know what the home budget is, figuring out a realistic amount for a downpayment becomes much easier.

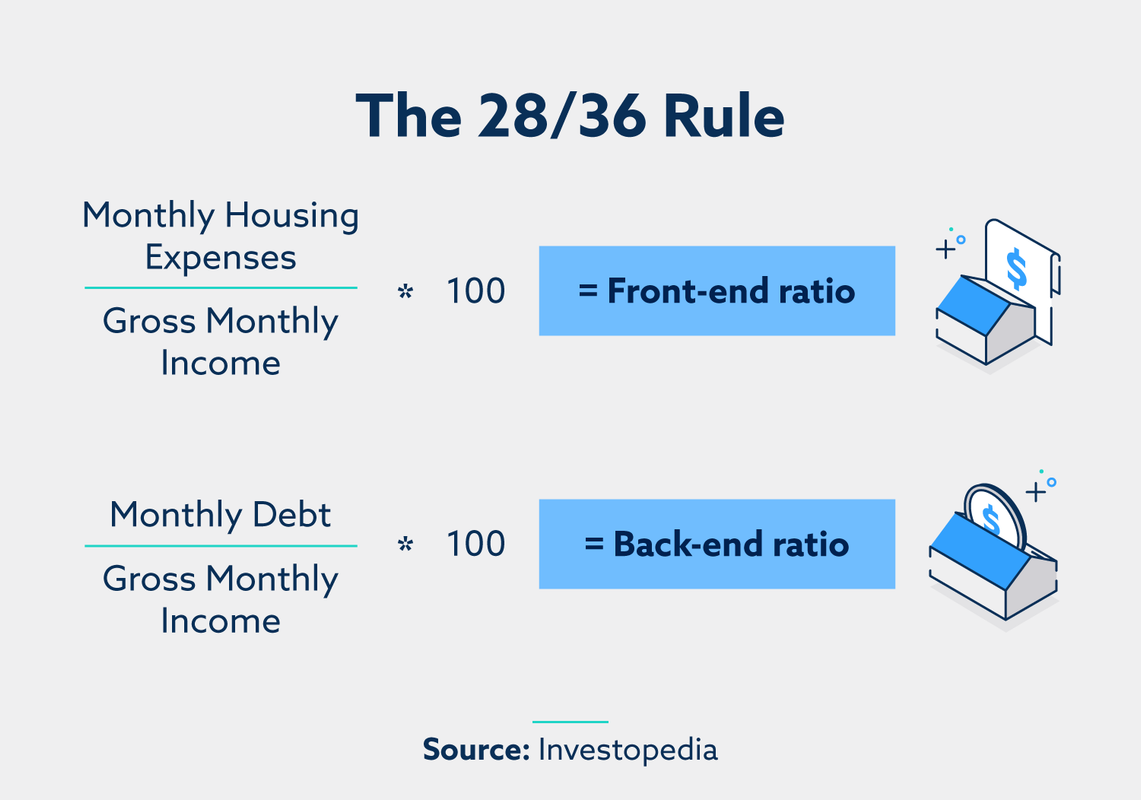

A general rule of thumb for coming up with a realistic home budget is by utilizing the 28/36 rule. You shouldn't spend more than 28% of your gross monthly income on house-related costs, and you shouldn't spend more than 36% on overall debts, including home costs, car payments, or credit cards.

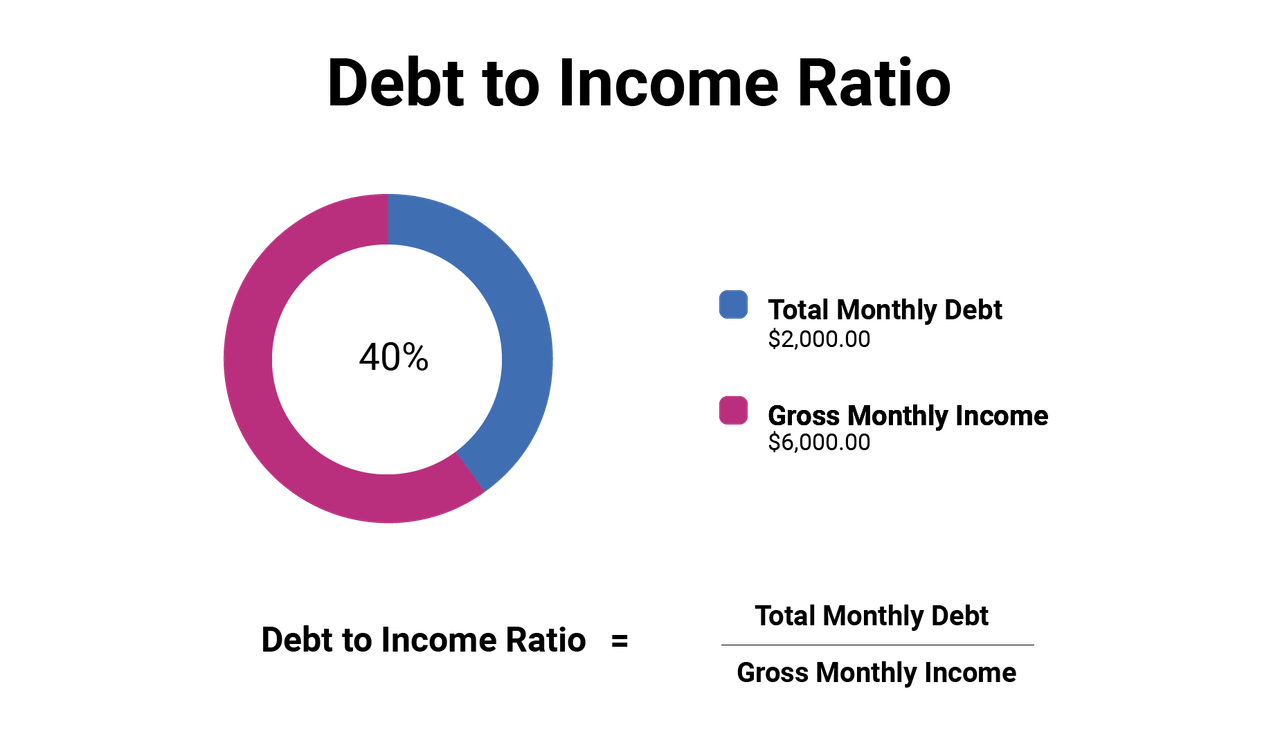

Some significant factors that determine your mortgage loan eligibility are your debt to income ratio and your credit score. If you have a high income but a high debt to income ratio, you might not qualify for a home at a price point you are considering. You could also have a high income, low debt, but low credit. Which could also lead to a loan rejection. It is best to speak with a mortgage lender to form an accurate understanding of your budget.

Once you know exactly how much you can spend on a house, you can have a number goal in mind for saving. Say you need to have $50,000 in cash for your home- and you are making $50,000 a year. You will need to save for a couple of years before you can buy a home.

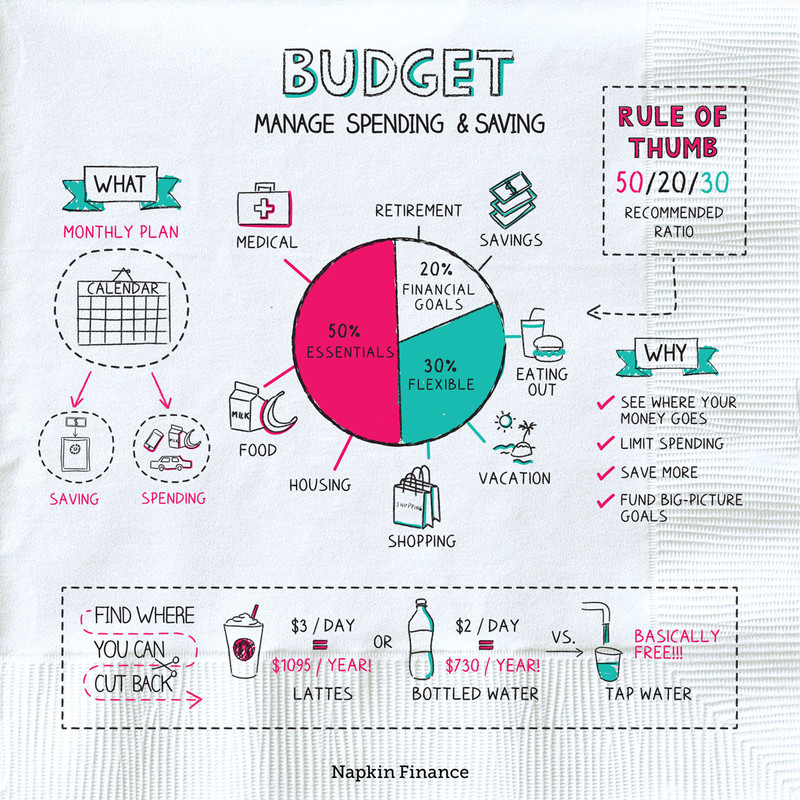

A good rule of thumb for general money saving is the 50/30/20 rule. This rule states you should spend 50% of your income on needs or essential spending. You should spend 30% of your income on non-essential spending or fun things. Then the remaining 20% of your budget should be delegated to debts or savings.

Mint is an excellent app for beginner savers or even seasoned savers. Mint is an app that helps users save money by showing them exactly where their money is going. With Mint, you can divide all of your spendings into graphs or pie charts to see how every cent is being spent.

A spending fast is a great way to begin saving money for a home. Try starting your spending fast by not spending any money for two days per week. That means no Amazon deliveries, no morning coffee, and no impulse buys. Consolidate all of your shopping for the week into one day and avoiding picking up anything extra on days that are dedicated to no spend days. Over time you can work on building yourself up to a 14-day no-spend period. The overall savings results will surprise you.

Downsizing isn't making do with less- it is making room for the most important things in life. Downsizing can seem hard if you're used to a certain size of space or standard of life. But down-sizing with an end date makes things easy. If you know you are only downsizing for a year, or six months it is easy to forgo your usual pleasures. You may be able to opt out of a guest room on your budget rental or the square footage you are used to.

Cooking at home is good for your waistline and your bottom line. Cut out take out, and cut back on eating at restaurants. On average, restaurant meals are five times as expensive as eating at home. Save five times your spend on food, by staying in!

Take a shopping hiatus. That means no online shopping, no mall trips, and no target trips. If you must shop, be sure to use discount sites like Rebaid so that you are not paying full price. Deciding to cut out shopping is easier than you might think, and will save the average American way more than you might expect.

If you're not asking for a raise of 2-3% every year, you might just be losing money. Many companies give raises of 2-3% each year to account for inflation. But aside from accounting for inflation, ask for a raise if you feel like you deserve one. Are you working often? Do you feel like an asset to your company? Ask for a raise. Until you ask, the answer is always no!

Adding a new stream of income has never been easier. Unlike someone seeking a second income stream in 1950, workers today just have to download an app. No hand-delivered resumes or lengthy interviews necessary. From the palm of your hand, you can become an Uber driver, a Postmates worker, or deliver take out in a matter of days. These additional income streams can make workers a decent amount of cash too.

If you aren't about downsizing and want to keep your guest room, consider using Airbnb. Rent out the spare room in your home for some extra cash. You could also rent out your car with TURO, or if you live in a city, you could rent out your parking spot. There are also various gear-sharing platforms where you can rent out your camping stuff or even your boat or kayaks if you have them.

Declutter and clean out your closet, then sell your stuff and make cash. Recently purchased and brand name clothing and accessories sell the fastest, but you can sell anything on platforms like Poshmark, Vestiaire, or Depop. If you want to keep the sale local, you could also use craigslist or Offer-up.

Last but not least, download an app that does the saving for you. There are multiple sites out there that you can connect to your bank account that will round up the difference of your purchases and put that difference into a savings account for you. Chime will do just that- and you can start saving every day without changing your habits!