If you are a frequent online shopper, you have probably heard of the more popular Buy Now Pay Later programs. Afterpay, Affirm, Klarna, and PayPal Pay in 4 are on plenty of major online retailers- and now even Apple is rolling out a new Buy Now Pay Later program.

These programs are growing in popularity amongst younger consumers- specifically young Millenials and Gen-Z'ers. And the concept seems straightforward enough; users simply purchase an item and then pay for it in multiple installments. As long as all payments are made on time, there is no interest. This seems like a convenient way to make purchases if you moved and need to buy a lot of things in one month- or if you want to try on a bunch of things at once.

Each one of these Buy Now Pay Later loans shows up on your credit report as a separate loan. And since the standard loan period for each of these loans is usually around six to eight weeks, they can significantly lower the average age of your credit history. Each time you pay off one of these POS loans, it is the equivalent of closing a credit account. Since credit history is a determining factor for 15% of your credit score, closing a POS loan can have the same effect on your credit score as closing a credit card account.

Many of these point of sale loans can negatively impact your credit score even if you're making all of your payments on time. Not all of the programs report to the credit bureau or run credit checks- but that brings up a whole other slew of problems.

Aside from the potential problems associated with taking out multiple short term loans, there are also the implications that come from BNPL programs that do not report payment history.

Suppose lenders are not able to see full borrowing history. In that case, they are likely to underestimate the borrowers' debt levels, which could lead to higher overall consumer debt and long term problems. There is also a very serious risk that consumers will rack up more credit card debt in an effort to pay off their Buy Now, Pay Later loans on time, or vice versa. Especially when taking into account the instances of BNPL leading to impulse spending.

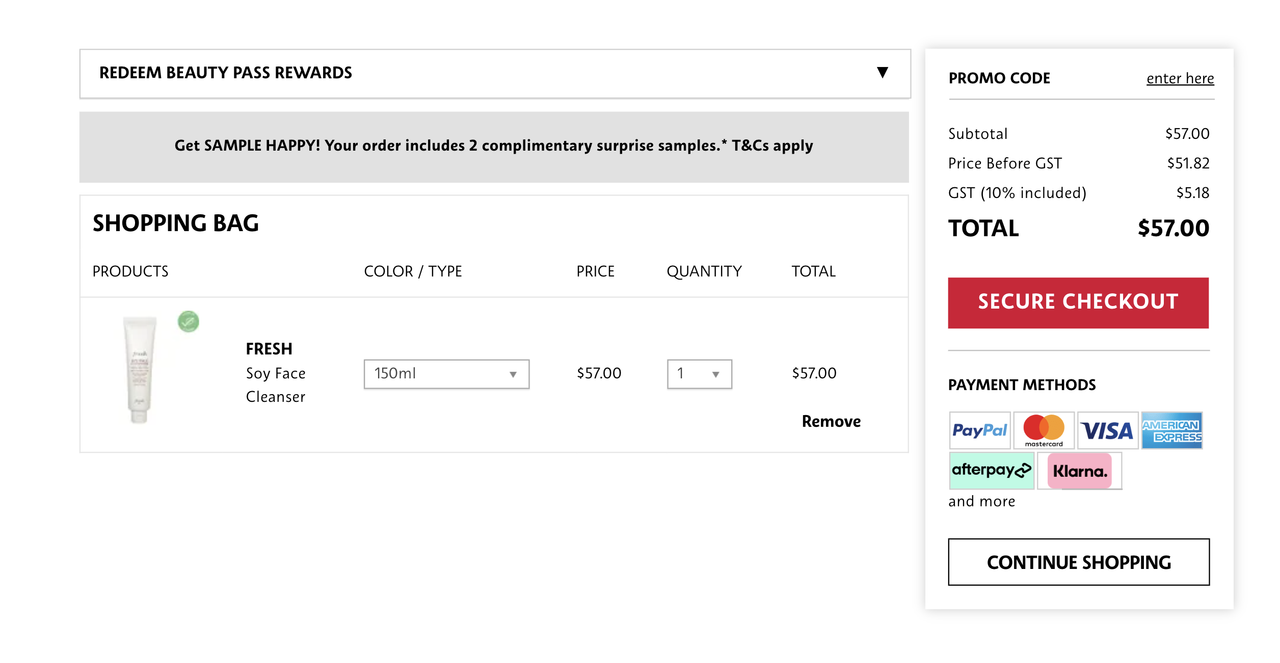

Klarna and Afterpay are two of the more well known Buy Now Pay Later programs- and they do not report to credit bureaus. Signing up for Afterpay is by far the easiest program, as it does not require any credit check at all to get approved. Klarna does a soft credit check at sign up, but does not report anything to the credit bureaus after that.

The Benefits of BNPL are obvious to the consumer, but what are these companies getting out of footing the bill? Companies like Afterpay make money by charging merchants a fee for use. Merchants tend to see a significant uptick in sales by adding the BNPL option to their sites and stores. So for online retailers, adding these services is a no brainer.

Online shops are charged a flat fee of 30 cents plus a commission that varies with the value and volume of transactions processed using Afterpay. The more that is sold, at a higher value, the lower the percentage fee will be. The fee ranges from 6% down to 4% per transaction.

Afterpay also makes money by charging late fees to consumers who miss their payment dates. It is said to be a "simple, though controversial" business model. If you default on your payment with Afterpay they give you a seven day grace period to pay them back, and then after that, they add $10 to the total purchase amount.

Other BNPL platforms are not so forgiving and will charge interest on missed payments, and sometimes even on the amount of time, you decide to pay them back in. For example, you can pay over two months with no interest or pay over one year with 25% interest.

Afterpay is the best buy now pay later option, as they do not make hard credit inquiries, nor do they report to the credit bureau. So there is no negative (or positive) effect on your credit score. As long as you use the service responsibility and avoid the urge to impulse spend- it should be a non issue.

You should avoid payment services like Affirm, that do hard credit checks and report to the credit bureau. Affirm typically services larger payments, and has a higher limit for consumers, so the extra requirements are necessary.

If you want to make a big purchase, look into saving up rather than splitting up payments. Check out our article How To Save Money Fast and learn how you can save money for your next big purchase!