No, really- all the cool kids are doing it. With hot new Apps and mainstream rap songs coming out all the time about Saving Money, it is safe to say- Saving is the coolest it has ever been.

Financial security means freedom. The faster you can start saving, the closer you are to financial freedom. When you are able to buy the home you want, book the vacations you want, and retire when you want, you are free. When you don't have to live paycheck to paycheck, you are free to just live! When you have money in the bank, you don't need to be locked into a job you hate or a place you don't want to live.

The best way to cut back on your spending can be done without cutting back at all. Try the simple act of keeping track of your daily spending, then re-evaluating at the end of a month. This reflection can inspire serious change in your spending habits without requiring you to set restrictive rules for yourself.

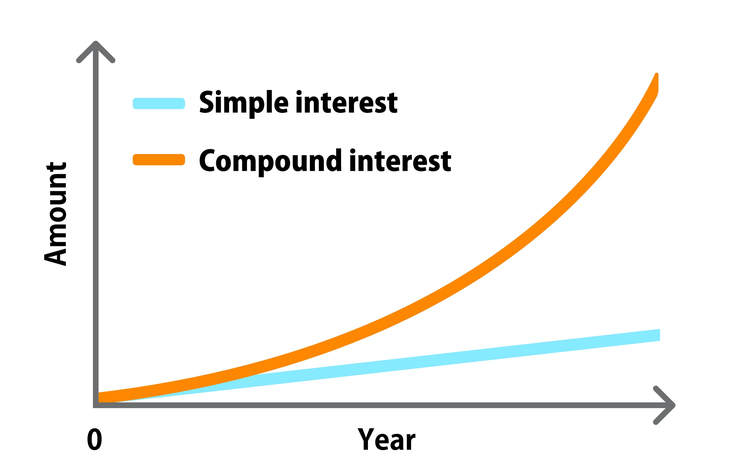

If you're not familiar with compound interest, you might want to be sitting down for what you are about to read. Compound interest has the potential to change your life. There is no better time to save than today. Even if you can only put a little money away, do it as quickly as possible because that interest could be working for you.

Why do you want to save money? What is your biggest inspiration? Do you want to save up for your kids future? Do you want to retire at 45? Do you want a house? Do you want to take a yearly vacation?

Figure out your "why," and let that be your reason to save. Having the desired outcome in mind can inspire change and make altering your current behavior easy. The more personal your reason, the more likely it is to ignite a fire within you!

Saving for a reason you are passionate about is 10x more effective than saving just to see a number unless, of course, you are emotionally attached to a certain number. Without a passionate reason to save, expenses will surely come up that you are passionate about that will outweigh your desire for your number goals.

Make sure your reason brings up intense feelings for you so that you can stay committed. Saying you want to have ten thousand dollars saved up seems like good motivation until you come across something more tangible.

There are a few ways to organize your spending. You can create a spreadsheet at the end of each month, week or day. Or you can go the modern route and use an app like Mint. Mint is a great option to organize spending. Mint connects to your bank account and your credit cards and tracks all of your purchases so that you don't have to. Mint also conveniently organizes these purchases into graphs and pie charts, so you know exactly where you are spending a lot and where you are spending a little.

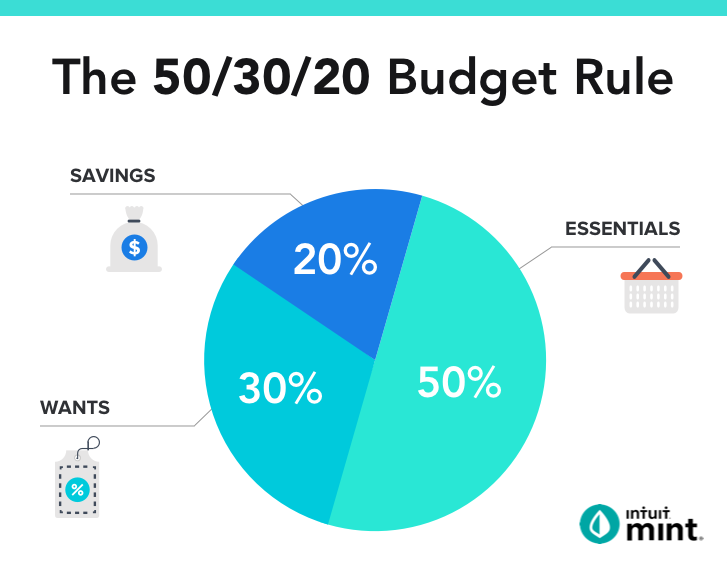

Once you know what your spending looks like, you can start creating a budget that works for you. Does your monthly spend align with the 50/30/20 rule? The 50/30/20 rule says financially savvy people should spend 50% of their income on necessities, 30% on wants, and 20% on savings.

But you don't need to follow this rule- come up with something that works for you! Just make sure your budget is realistic. There is no sense in making a budget that says to cut out eating out for the next year if you're not going to be able to adhere to that. Be practical!

Create spending categories. You're less likely to skimp on your savings goals if you are allocating each dollar to something you want. For example, if you have a "House Fund" a "College Fund" and a "Vacation Fund" it will be hard to decide which fund to short if you're deciding to save less. Keep your goals clear by labeling them.

Once you have your reason for saving in mind, figure out your desired timeline by addressing your current timeline. How long it will take you to get to your end goal while maintaining your current spending habits. If you're only saving two hundred dollars per month, how old will you be before you can finally buy your dream house? How many months will it take for you to save up for your dream vacation? These are all critical questions to ask yourself when setting up a budget.

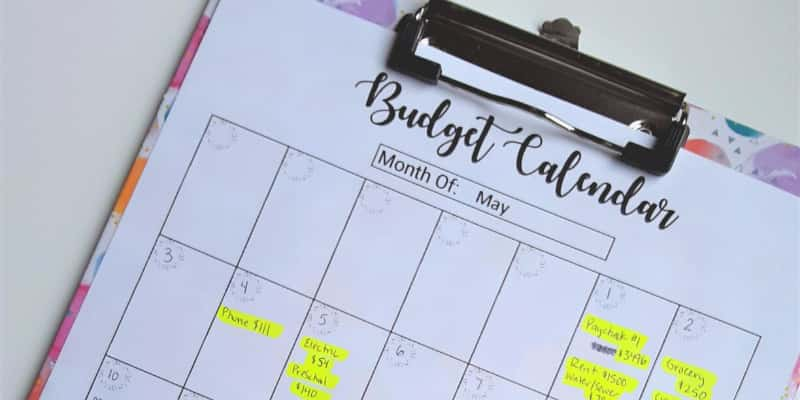

Make your goals tangible by creating calendar benchmarks. The best way to ensure you get what you want is to plan for what you want. Create your budget based on your life. Decide when you want to accomplish your goals using due dates and calendars. Make a savings goal for each week, month, and year.

The smaller the goal, the easier it is to achieve. Taking baby steps is a great way to build confidence in the process and achieve your saving goals. To start, divide your budget into seven-day increments. It's a lot easier to say, "I'm not going to eat out this week" than it is to say "I'm not going to eat out this month." Set savings goals, then check in on them once per week to make sure you are still on track to meet your monthly and yearly targets.

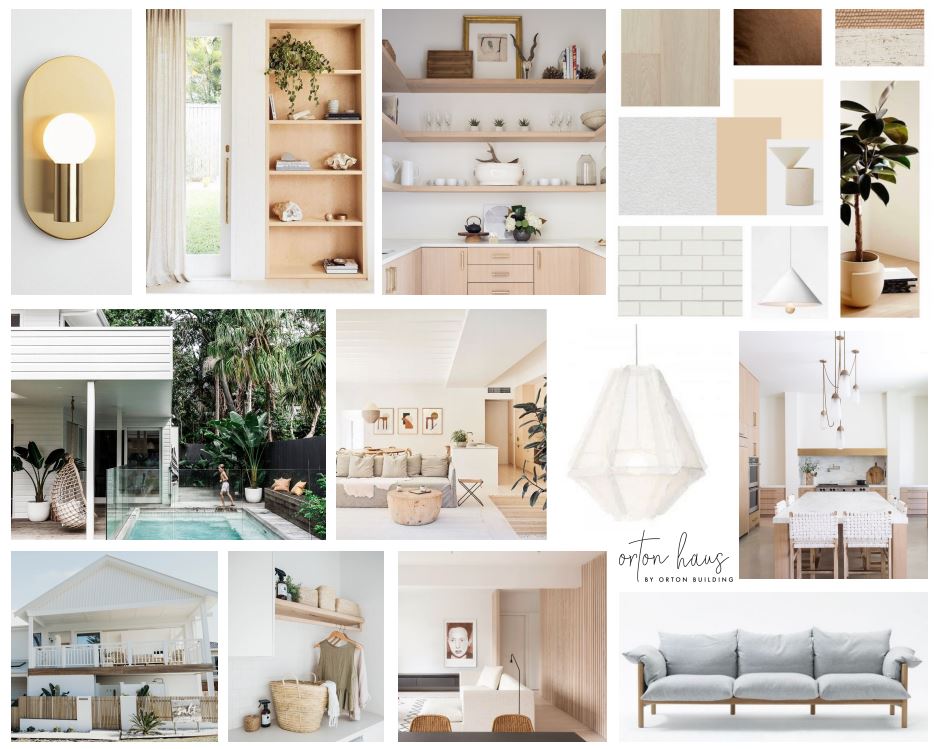

This may sound silly, but countless celebrities and entrepreneurs attribute their successes in life to dream boarding. Drake says that the current house he lives in was his screen saver before he owned it, or could even afford the mortgage. Jim Carrey wrote himself a ten million dollar check and would drive to the top of the Hollywood Hills and scream "I'm a millionaire' until he believed it, then he would drive back down the hill. This wasn't a dream board per se, but it was the exact same concept. Jim Carrey brought his dream into his tangible reality by creating a visual for himself.

Honor your small achievements through celebration. Saving money doesn't have to be all serious and no fun. Reward yourself for not going out to dinner three weekends in a row by going out with your friends on the fourth weekend. As long as you don't overdo it on the spending- celebration is key to success. Finding ways to celebrate is important for your growth and for maintaining balance in your life.